Taka Pay Card Charge in Bangladesh – Full List of Fees Explained

Find out all details about Taka Pay Card charge in Bangladesh. ATM, annual, online, POS charges – everything explained in easy Bangladeshi English.

|

| TakaPayCard |

Taka Pay Card Charge in Bangladesh – Full List of Fees Explained

If you’re planning to get a Taka Pay Card or already using one, you might be asking: “What is the taka pay card charge?” In this post, we’ll explain all possible fees and charges you need to know, in simple Bangladeshi English.

🏦 What is a Taka Pay Card?

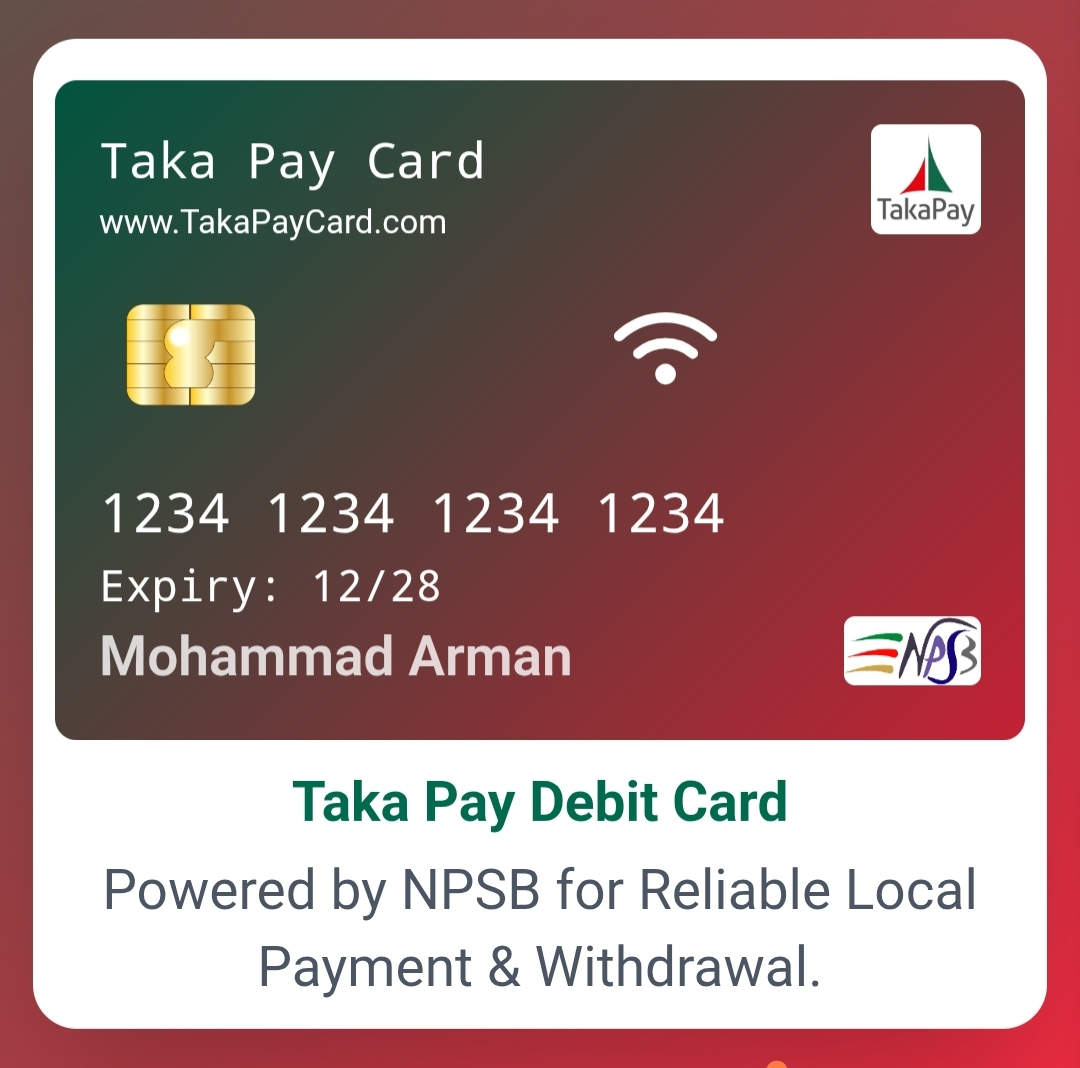

A Taka Pay Card is a Bangladeshi national debit card, designed for use only in BDT currency and within Bangladesh. It is issued by many local banks like BRAC Bank, DBBL, City Bank, and others. The system is powered by NPSB (National Payment Switch Bangladesh).

🖥️ Learn more at:

👉 Bangladesh Bank Official Website – NPSB Info

💸 Taka Pay Card Charge – Full List

Let’s break down all the taka pay card charge types one by one:

1. Card Issuance Fee

-

BDT 200 – 500 (One-time)

-

Depends on the bank

-

Some banks offer it free for first-time customers

2. Annual Charge

-

BDT 200 – 300 per year

-

Lower than Visa or Mastercard

-

Some banks give 1st year free

3. ATM Withdrawal Charge

-

Own bank ATM: Free

-

Other bank ATM (NPSB): BDT 15 – 25 per transaction

-

Daily withdrawal limit: usually BDT 20,000 – 50,000

4. POS (Shop Payment) Charge

-

Free of charge at most shops

-

No extra bank fee for in-store payments

5. Online Payment Charge

-

Very low or no charge when paying on Bangladeshi websites

-

Example: bKash, Daraz, SSLCommerz-powered sites

6. Card Replacement Fee

-

If card is lost or damaged: BDT 200 – 300

7. SMS Alert Charge

-

Optional

-

BDT 15 – 25 per quarter

📊 Taka Pay Card vs Visa/Mastercard – Charge Comparison

| Feature | Taka Pay Card | Visa / Mastercard |

|---|---|---|

| Annual Fee | 200–300 BDT | 500–1200 BDT |

| ATM Charge (Own Bank) | Free | Free |

| ATM Charge (Other Bank) | 15–25 BDT | 20–30 BDT |

| International Use | ❌ No | ✅ Yes |

| Currency | Only BDT | Any |

| Hidden Fees | ❌ No | Sometimes High |

🤔 Why Is the Taka Pay Card Cheaper?

-

Uses local system (NPSB)

-

No foreign currency handling

-

Supported by Bangladesh Bank

-

Promotes Digital Bangladesh

🏦 Bank Wise Taka Pay Card Charge Example

BRAC Bank Taka Pay Card Charge:

-

Card fee: BDT 300

-

Annual fee: BDT 200

-

ATM at other bank: BDT 20

-

Replacement: BDT 250

🔗 BRAC Bank Taka Pay Info

DBBL Taka Pay Card Charge:

-

Card fee: Free for student account

-

Annual fee: BDT 150

-

ATM (other bank): BDT 15

Check individual bank websites for up-to-date charges.

❓ Frequently Asked Questions (FAQs)

Q1: What is the taka pay card charge for ATM withdrawal?

A: Free on own bank ATM, around BDT 15–25 when using another bank’s ATM.

Q2: Is there any hidden fee?

A: No major hidden fees. Always check your bank’s terms.

Q3: How much is the annual fee for taka pay card?

A: Usually BDT 200–300 depending on your bank.

Q4: Can I use taka pay card internationally?

A: No, it only works inside Bangladesh in BDT.

Q5: Is taka pay card cheaper than Visa or MasterCard?

A: Yes, the taka pay card charge is much lower for most services.

📝 Final Thoughts

The taka pay card charge is quite low and affordable for most users in Bangladesh. It's a great option for daily use, local online shopping, and ATM withdrawal. It also supports Digital Bangladesh and keeps money flowing within the country.

If you want a budget-friendly debit card with no foreign fees – this is a smart choice!

External Resource Links